- The Committee on Digital Payments constituted by the Ministry of Finance, Department of Economic Affairs under the Chairmanship of Ratan P. Watal, Principal Advisor, NITI Aayog and former Finance Secretary to the Government of India recently submitted its Final Report.

- The Committee had earlier submitted an Interim Report to Ministry of Finance on 21st November

Key Highlights

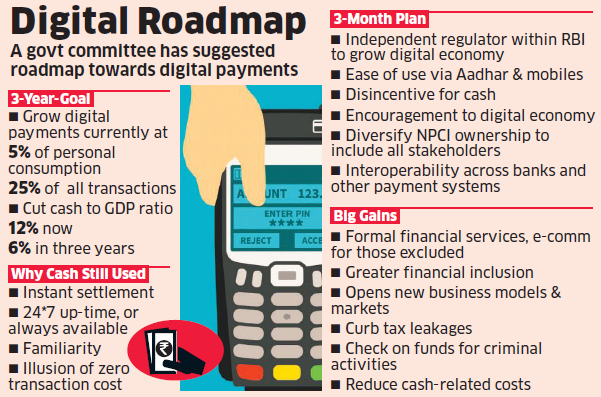

1-In its report the Committee has recommended that a medium term strategy for accelerating growth of Digital Payments in India with a regulatory regime which is conducive to bridging the Digital divide by promoting competition, open access & interoperability in payments.

Terms of Reference for the Committee

- To identify regulatory bottlenecks, if any, and suggest changes to promote payment by card/digital means

- To study and make recommendations on any other matter related to promotion of payments through Cards and Digital Means

Other Key Recommendations

- The Committee headed by former finance secretary Ratan Watal also recommends a number of regulatory changes along with those to the primary legislation.

- It has suggested two options for regulating digital payment—either create an independent payments regulator within the framework of the Reserve Bank of India (RBI) or make the RBI’s Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) more independent.

- The committee had recommended giving independent status to BPSS, to be called the Payments Regulatory Board (PRB), the structure of which will be finalized in the next 30 days.

- National Payments Corp. of India (NPCI) has been asked to enable this on its platform over the next 60 days.

- RBI has also been asked to upgrade the existing real-time gross settlement system (RTGS) and National Electronic Funds Transfer (NEFT) systems so that they operate on a 24/7 basis.

The Committee said, “India’s dependency on cash imposes an estimated cost of approximately Rs 21,000 crore on account of various aspects of currency operations including cost of printing new currency, costs of currency chest, costs of maintaining supply to ATM networks, and interests accrued. This estimate does not reflect other external costs imposed by the use of cash, including the costs imposed by counterfeit currency and black money