Demonetisation refers to the process by which currency notes in the Economy cease to be legal tender. On 8th November 2016, the Govt of India (GoI) notified that existing currency notes of Rs 500 and Rs 1000 denomination (Mahatma Gandhi series) will cease to be legal tender. All citizens were asked to deposit their cash held in Rs 500 and Rs 1000 denomination bank notes in their bank accounts by 30th December. They could also exchange their cash with new bank notes and notes of other denominations subject to various limits and conditions.

HISTORY OF DEMONETISATION

(1)First Denom- 12 Jan 1946

The idea seems to have come from the colonial master Britain where 10 Pound notes were called back:

Soon after the war, while Government were giving attention to ways and means of averting the expected slump, thought was also given to check black market operations and tax evasion, which were known to have occurred on a considerable scale. Following the action in several foreign countries, including France, Belgium and the U.K., the Government of India decided on demonetisation of high denomination notes, in January 1946. It is interesting that as early as April 7, 1945. in an editorial on the tasks before the new Finance Member, Sir Archibald Rowlands, the Indian Finance referred to the action of the Bank of England in calling in notes of ₤ 10 and higher denominations and suggested similar action in India as ‘one more concrete example for the Indian Government

So, based on whatever inputs the govt came out with 2 ordinances on 12 Jan 1946, which was declared a holiday. First ordinance asked banks to furnish info about currency holdings of various denominations (Rs.100, Rs. 500, Rs. 1,000 and Rs.10,000). Second was about telling public that denominations of Rs. 500 and above were demoned. Rs 100 was spared.

People were given 10 days for exchange which meant first helpline ended at 23 Jan. This was later extended to 9 Feb where people had to give explanations on why they could not in first ten days.

In the end, out of a total issue of Rs.143.97 crores, notes of the value of Rs.134.9 crores were exchanged up to the end of 1947 as mentioned in the Report of the Board of Directors of the Reserve Bank. Thus, notes worth only Rs.9.07 crores were probably “‘demonetised “,not having been presented. It was more of “conversion “, at varying rates of profits and losses than “demonetisation “.

At that time, one did not introduce any new currency and exchanges were made with Rs 100 and lower.The success of demon then was seen as lower amount of exchange of notes.

Second Denom — 16 Jan 1978

The Finance Minister H.M. Patel in his budget speech on 28 Feb 1978 remarked:

There has been concern in recent months over the behaviour of agricultural prices particularly of edible oils. In spite of a bumper harvest agricultural prices are ruling much higher than after the poor harvest of 1976- 77. Massive imports of edible oil have failed to bring down prices and the mustard oil price control order has failed miserably to give the consumer his requirements at the specified rate. There has been a feeling that a considerable amount of black money has gone to finance hoarding and speculation. The demonetisation of high denomination currency notes will hit black money hard.”

As the FM did not say anything about the success of the exercise, one can almost guess that it did not create much impact like in 1946.

A CBDT report which evaluated this measure concluded that

- It was an ineffective move as only 15% of the high denominations were exchanged

- The rest never surfaced for the fear of stringent penalty by government. As per the High Denomination Bank Notes (Demonetization) Act, 1978, it barred the transfer and receipt of high denomination bank notes and made any contravention including false declaration by depositors and others punishable — with a fine or a three year prison term

- The report concluded that demonetization may not be a solution as black money was largely held in the form of benami properties, bullion and jewellary. Such a measure would only increase the cost as more currency notes which have to be printed. It could also have an adverse impact on the banking logistics

(In the present age the European Central Bank has announced that it would demonetize €500 note)

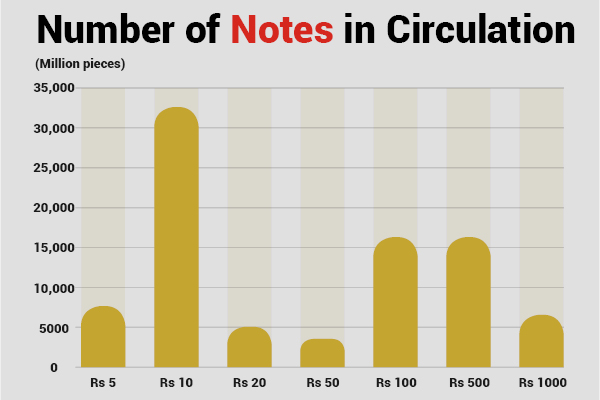

- India has one of the highest levels of currencies in circulation which is more than 12% of its GDP value; and the 1000 and 500 rupee notes account for 24.4% (around 2300 crore pieces) of currencies in circulation but for over 85% in terms of value of the currency in circulation Having said so it has to be kept in mind that India is not an outlier in this segment as there are various other countries such as USAs $100 note and Japan’s ¥10000 account for over 80% of currencies under circulation.

|

Denomination |

Number of Units in Circulation (in millions) |

%age of units out of the total circulation |

%age value out of the total value of notes |

|

Rs 100 note |

15778 |

17.5 |

09.6 |

|

Rs 500 note |

15707 |

17.4 |

47.8 |

|

Rs 1000 note |

06326 |

07.0 |

38.6 |

Cash is the king – In India majority of the transactions are done in the form of cash

- As per RBI, 87% of the transactions in India are cash transactions

- As per RBI report, debit cards at ATMs account for 88% and 94% (by volume and value respectively) of the debit card transactions and 12% and 6% account for POS transactions.

- The infrastructure growth is slow – The POS machines and ATMs are 1.2 million (and there are around 14 million merchants in India, in essence more than 90% of the merchants are not using the POS machines) and 0.19 million respectively. (From 2013 to 2015, ATMs increased by 43% and POS machines by 28%)

Reasons

- ATMs and POS machines are concentrated in urban area

- Penetration in non-urban areas is very poor add to this, the connectivity issues

- Even if the POS machines are installed, low value transactions are discouraged by the merchants

Silver lining

- The number of card issued are on the rise

- The acceptance infrastructure has to be placed

- Increasing trade on e-commerce (provided it promotes online payments/transactions)

- Increasing number of digital wallets-Paytm, Pockets etc

- The government has implemented Jan Dhan Yojana and under this a large population has been able to open their accounts which will be helpful (in the sense the debit cards issued have increased)

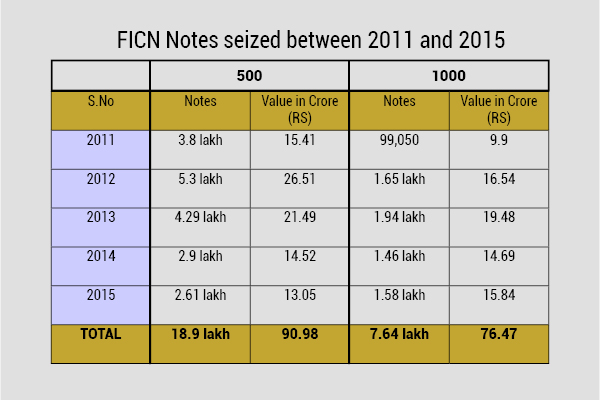

Menace of counterfeit currency (FICN-Fake Indian Currency Notes)

- As per the statements given in RS by Arjun Ram Meghawal (Minister of State for Finance), the total FICN is to the tune of Rs 400 Cr

- As per the Lok Sabha Website between 2011 and 2015, the RBI has seized around 26 lakh counterfeit notes of denomination Rs 500 and Rs 1000 amounting to Rs 167 Cr

- Amongst the two, FICN of Rs 500 currency notes were higher (both in numbers and in value)

- As per a study done by ISI (Indian Statistical Institute), at any given point of time, the FICN is to the tune of Rs400 Cr and annually the FICN pumped into the economy is Rs 70 Cr

Measures taken

- FCORD (FICN Co-Ordination) group has been set up by MHA (Ministry of Home Affairs) to share the information with other security agencies regarding controlling FICN

- The MHA (Ministry of Home Affairs) has set up CCT Cell (Combating Financing of Terrorism Cell) to co-ordinate with FATF (Financial Action Task Force- it’s a intergovernmental body has remarked that high value bills are used in money laundering schemes, racketeering, and drug and people trafficking)

- TFFC (Terror Funding and Fake Currency Cell) has been set up under NIA (National Investigation Agency) to investigate the terror financing using FICN

- MoU (Memorandum of Understanding) has been signed between India and Bangladesh to prevent circulation and smuggling of FICN (majority of the inflows of FICN is done through Pakistan, Nepal and Bangladesh)

Less cash Vs Cashless

Debate has been raging in India over the need for the country to become a cashless economy but the fact of the matter is that sudden shift from cash based to cashless will have huge repercussions and not to forget that cash facilitates trade, hence there is a need for India to first move into less-cash economy (one of the aims in introducing Rs 2000 note) and then move towards becoming a cashless economy

Views of Raghuram Rajan (again there are many economists who have the same viewpoint)

- The intelligent always find a way around when the currency are demonetized

- It becomes much more difficult if they have stored the black money in other forms-gold, asset etc

- So the way out is that rather than running behind these measures, we must implement the systems, procedures which will bring all those who are supposed to pay the tax, under the tax bracket and we can collect the appropriate taxes from them (as in India, the highest rate of taxation is around 33%, whereas in America, after including the federal and state taxes the tax rates are around 50% and in case of UK it is hovering around 45%)

Pros of Demonetization

- The menace of black money can be controlled to some extent

- Terror financing, using black money for illegal activities etc will all take a hit

- The counterfeit currencies which have an impact on the real economy, will be rooted out

- The mobilization of deposits in the banks will increase, which may lead to increased credit flow and lowering of lending rates

- The black money adds to the inconspicuous demand and hence the inflation to some extent will be under control

- The government is also aiming to raise its revenue collection (eg- by taxing exorbitant IT rates over certain deposits, the tax collection in other forms will also increase etc)

- The real estate is one of the major sources of black money generation. With this move it is expected that the property market rates may bottom out or moderate

- It’s a major step by the government towards forming a cashless economy

- The honest workers will be rewarded under such scenario

- The elections are usually associated with black money generation and circulation, with this scheme the funding of elections through nefarious ways will be hit

- It is expected that with this move the Fiscal Deficit of the government may come down

Cons of Demonetization

- For one all the black money is not stored in the form of cash only and secondly the measure takes care of result but not the cause-black money is generated mainly because of corruption and tax evasion. This measure controls the usage of black money but cannot control the causes

- Sudden and huge demand for the new currencies

- Panic amongst the common man (already we have seen the case wherein people have looted fair price shop in MP, Cash Carrying companies seeking higher insurance etc). already the panic has led to people hoarding currencies which has further reduced the liquidity in the market

- The small trade/shopkeepers are facing difficulties

- Black marketing of the new notes/currencies is on the rise

- The establishments such as banks, hospitals etc are under lot of stress

- Another area which is a cause of worry is the likely drop in the rural demand as the cash usage will become restricted. Apart from this the experts are also expecting an impact on SME sector, agricultural production (the economy was expected to perform well as there was an expectation of a good rabi crop after two bad monsoons but a prominent economist, Pronab Sen has said that demonetization is akin to third bad monsoon year as it will have an impact on agricultural production, but the more dangerous situation is this having a spillover effect on to fertilizer, tractor sectors)

- Challenges

- The coverage of the banking sector-

- Only 27% of the villages have a bank within 5 Kms (as per Economic Survey 2015-16)

- In spite of recording breaking implementation of JDY, the banking penetration is low-on an average 46% in all the states (as per Economic Survey 2015-16)

- Another challenge in implementing and eradicating black money would be presence of informal economy. It accounts for 45% of GDP and 80% of employment hence this move may have a greater impact on informal economy

- Logistics and cost challenges of replacing all the Rs 500 and Rs 1000 notes – as per the RBI documents this measure would cost at least Rs 12000 crore as it has to replace over 2300 crore pieces of these currencies

- The decision to issue Rs 2000 denomination currency and withdrawal of Rs 500 and Rs 1000 currency will lead to huge challenge as most of the day to day transactions in India are centered around Rs 500 note (more than 47% of the value of notes in circulation is in Rs 500 note form)

- The availability of Rs 500 and Rs 1000 notes will be the biggest challenge as both of them covered over 85% in terms of value of total currencies issued

- The process has led to huge rush and long queues of the people in front of ATMs and as per the statement of finance minister the ATM recalibration would take around 2 to 3 weeks

- As per data furnished by the Finance Ministry, Rs 17,50,000 crore worth of currency notes were in circulation in October-end, out of which over 85% per cent or Rs 14,50,000 crore is in the now defunct Rs 500 and Rs 1,000 notes. So far for the first four days the government has been able to pump in Rs 50000 cr (on an average 12500 Cr). Going by these numbers it would take around 4 months to replace these notes as against the 50 days promised by the PM

- The coverage of the banking sector-

- Worries

- The rural demand even after a good monsoon is unlikely to pick up and agriculture production is unlikely to achieve 3.5 to 4% GDP growth rate

- As per Prof Bhanumurthy (NIPFP) all the black money may not find its way to the banks hence GDP growth rate may come down by 1.1% (the professor has also remarked that the money which was not there in the system is being pumped in and add to this if the online transactions are promoted then the GDP growth may pick up rather than declining)

- As per economist Pronab Sen this may lead to lowering of GDP by 0.2 to 0.3% and in extreme cases we may end up achieving 7% (targeted is 8%)

The opportunists

The online service providers have up their ante when there is a shortage of currency notes, pushing their products/services by providing discounts, coupons, credit etc. For example Paytm, which is the largest mobile wallet company, has said that it (since the ban kicked in)

- Has seen a 700% increase in overall traffic on the platform

- 1000% growth in the value of money added to the Paytm accounts

- Average transaction value has increased by 200%

- Mobile app downloads have increased by 300%

- Has processed around 5 million transactions each on 12thand 13th (Saturday and Sunday respectively) of this month

The future

There is no doubt that the coming months will be painful for the common man, small businesses, housewives etc as there will be some shortage of legal tender/currency that will have an impact on them. Another rising issue will be that the demand for POS machines, Debit Cards which has to be resolved lest the measures will become an obstacle rather than the solution.

If these measures are implemented efficiently then we can expect higher collection of taxes, higher investments in the market, price corrections, improvement of India in some of the international rankings, prevent corruption practices etc and these are some of the reasons why people although are going through difficulties are lauding this measure of the government

But after having discussed so much, will this measure eliminate all the black money in the economy? The answer simply would be a confirmative NO as it has been seen that the black money is stored in various forms other than cash (such as gold, jewellary, assets etc) and as per A 2012 report prepared by National Institute of Financial Management – on unaccounted income – found that cash was the least preferred option for storing unaccounted wealth

Other measures taken by the present government in controlling the menace of black money

- One of the first cabinet decisions taken by the government was to set up SIT (Special Investigation Team) on Black Money

- The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, came into force on July 1, 2015 under which the tax rate imposed was 60%

- Further upon the leaks of Panama Papers, the government constituted a Multi-Agency Group (MAG) comprising officers of the Central Board of Direct Taxes, Reserve Bank of India, Enforcement Directorate and Financial Intelligence Unit.

- Lok Sabha recently has passed the Benami Transaction Bill, 2015 which is an anti-black money measure which aims to seize unknown property and prosecute those indulging in such activities.

- This year the government has amended its DTAAs and is in negotiations with some other countries

- It is also under negotiations with the authorities in Switzerland in signing Automatic Exchange of Information (AEOI)

- In this year’s budget government had announced IDS (Income Declaration Scheme) under which it has successfully collected Rs 65250 crore in the form of taxes

Conclusion-

Central government’s recent decision to demonetise the high value currency is one of the major step towards the eradication of black money in India. The demonetization drive will affect some extent to the general public, but for larger interest of the country such decisions are inevitable. Also it may not curb black money fully, but definitely it has major impact in curbing black money to large extent

Approach to the Mains Examination

GS 3

- What is demonetization? Critically analyze the recent initiative of the government

- Discuss the various initiatives the government in controlling the menace of black money

- Is India ready to transform from cash based to cashless society? What are the different challenges that could be faced in this transmission?